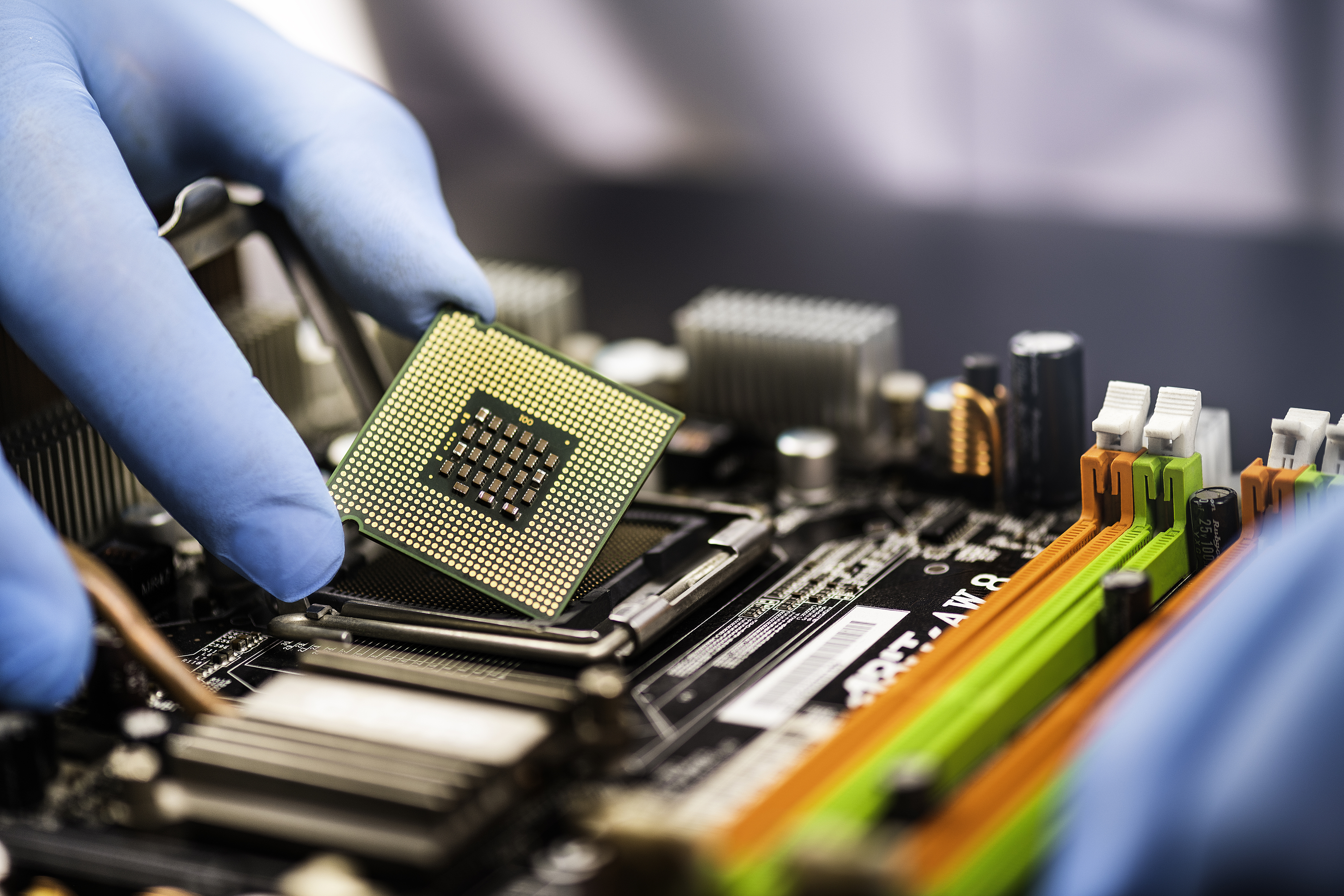

The New York Times reports in “Senate Passes $280 Billion Industrial Policy Bill to Counter China” that “the bill, a convergence of economic and national security policy, would provide $52 billion in subsidies and additional tax credits to companies that manufacture chips in the United States. It also would add $200 billion for scientific research, especially into artificial intelligence, robotics, quantum computing and a variety of other technologies.”

Sen. Bernie Sanders denounced the doling out of “corporate welfare”: “My colleagues often say they’re concerned about the deficit. Well, if they’re really concerned, let us not give a … blank check to the highly profitable microchip industry with no protections at all for the American taxpayer.” He and about 30 Republicans voted against the measure.

WILLIAM LAZONICK, william.lazonick@gmail.comLazonick is president of the Academic-Industry Research Network and professor emeritus of economics at the University of Massachusetts.

He has co-authored a series of relevant papers for the Institute for New Economic Thinking, including “Why the CHIPS Are Down: Stock Buybacks and Subsidies in the U.S. Semiconductor Industry.”

He said today: “In 2012-2021, nine tech companies that have lobbied for the CHIPS Act — Alphabet, Apple, Broadcom, Cisco, IBM, Intel, Microsoft, Qualcomm, and Texas Instruments — spent over one trillion dollars on buying back shares of their own stocks, 20 times the Act’s $52 billion. A major reason for the U.S. loss of global leadership, not just in semiconductors but in a range of critical technologies, has been the corporate obsession with raising stock prices, which is the prime purpose of repurchasing shares on the open market.”

Another paper by Lazonick is “How Intel Financialized and Lost Leadership in Semiconductor Fabrication.” He summarized: “As a sterling example, Intel fell behind in global competition over the last decade not because it lacked cash, but because its top management was more concerned with boosting the company’s stock price than with implementing cutting-edge fabrication processes. Indeed, as a condition for taking over as Intel CEO in February 2021, Pat Gelsinger told the Intel board: ‘We’re done with buybacks. We are investing in factories.’ Congress should insist that no company that does buybacks should be eligible for CHIPS Act subsidies.”

Also see his piece “Does America Want a CHIPS for Buybacks Act?“