SERVAAS STORM, [in the Netherlands, for print reporters] S.T.H.Storm@

PIA MALANEY, pmalaney@

Storm is senior lecturer of economics at Delft University of Technology in the Netherlands. His “Inflation in the Time of Corona and War” [full PDF] has just been published by the Institute for New Economic Thinking in New York.

Malaney is senior economist at the Institute for New Economic Thinking. She was recently featured on the IPA news release: “Fed’s Fix is Wrong: Inflation Caused by ‘Skyrocketing’ Corporate Profits More Than Wages.”

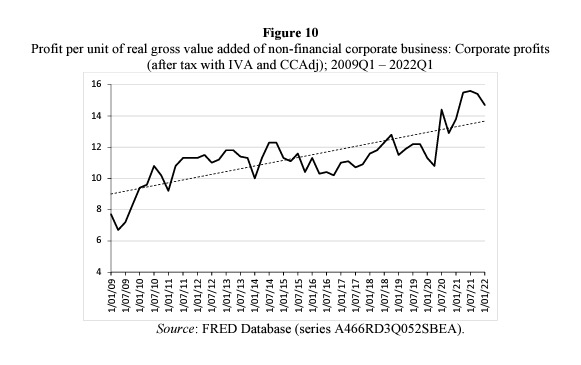

Storm writes in his new paper: “The non-financial corporate profits per unit of real GDP have increased from 10.8 percent in 2020 Q2 to 15.6 percent in 2021 Q3 during the corona-period [see Figure 10]. Nominal growth of corporate profits (by 35 percent) during 2021 has vastly outstripped nominal increases in the compensation of employees (10 percent) as well as the PCE [personal consumption expenditure] inflation rate (6.1 percent). According to The Wall Street Journal, nearly two out of three of the biggest U.S. publicly traded companies had larger profit margins this year than they did in 2019, prior to the pandemic. Nearly 100 of these corporations did report profits in 2021 that are 50 percent above profit margins from 2019. Evidence from corporate earnings calls shows that CEOs are boasting about their ‘pricing power,’ meaning the ability to raise prices without losing customers. Even the Chair of the Federal Reserve, Jerome Powell, has weighed in on this issue, stating that large corporations with near monopolistic market power are ‘raising prices because they can.’ These profit increases have contributed to a process of profit-price inflation.”